May

AI In Market Research: The Story So Far – Chapter 1: Adapt or Get Left Behind

jerry9789 0 comments artificial intelligence, Burning Questions

Whether or you like it or not, AI is here to stay. Yes, AI is a threat to most jobs, including those in the market research industry, since it shortcuts processes while optimizing operational efficiency. While market research technology didn’t develop as fast as other industries in the early to mid-2000s, the advent and subsequent mainstream appeal of AI has forced market research to get with the times. You’re in trouble if you fail to embrace it but if you do, you get to be on the winning side.

Experts expressed that we’re still in the early exploratory stages of AI but there is already depth in its application in market research. Take for example, the humanization of surveys. An interactive and dynamically probing AI improved overall data quality in more than one experiment due to an increased engagement from respondents resulting from a sense of appreciation over the perceived but simulated attention paid to them and their responses during the survey. In the same vein, employing a conversational AI voice has been shown to dramatically drive engagement for better data.

That latter effort to humanize survey has created an influx of voice responses and content, leading to the new question of what we now should do with all that resources, which would be a common byproduct of AI-based solutions. Of course, LLMs and other existing AI models would be employed to help find the answer to this question.

Aside from solving dark data, AI have also displayed impressive capabilities to answer choice tasks, especially performing well with well-known topics and products, even outdoing humans in some surveys where they get confused or find it hard to render judgment. It’s also been considered for AI to adapt existing survey data for a new topic to save time. AI’s role in market research might still be experimental at this point, but it has grown to the point where it’s being utilized and adapted to take on one challenge after another.

May

AI Webinars Are Everywhere – What Are They Really Saying?

jerry9789 0 comments artificial intelligence, Burning Questions

With AI growing to be more ubiquitous with each passing year, it’s no surprise that webinars dedicated to the subject has been springing up everywhere. Amidst the hype, people are either curious, interested, or to some degree, invested about what AI’s increasing popularity means for them as well as the industries their part of. These webinars serve as the perfect platform for industry experts to share their experiences, thoughts, and opinions on AI’s present and future implications.

And on such note, we sent one of our staff in search of the answers. What are these webinars about AI in market research saying? Sure, they each talk about the impact of AI on a variety of aspects of the market research industry, but they must share some common themes or overarching ideas.

During April 2024, our staff member attended three AI webinars: “Market Research in an AI World,” “AI in Marketing Research: Expert Panel Discussion,” and “Building New Business: Five Ways Firms Are Driving New Revenue with Automation And AI.” After every webinar, our staff member was asked to not only summarize what was discussed and what he had learned but also share his thoughts and perspectives.

Our staff member eventually boiled things down to four main ideas or themes. In this series of blogs, we’ll be exploring each of those themes. Here’s the first in our series. It focuses on why people in the market research industry need to pay attention to AI.

May

How A Market Research Company Can Help a Consulting Firm

jerry9789 0 comments Burning Questions, Uncategorized

You’re familiar with this scenario: a business organization runs into a problem they can’t solve in-house, so they turn to your consulting firm to help figure out the solution. The problem turns out to be more complicated than anyone could imagine but thanks to your experience and expertise, you were able to come up with a strategy to solve it for good. Here’s the twist: given the complexity of the problem, the business wants you to back up your solution with something other than your experience and expertise, something that would help them understand what caused the issue and why your strategy is effective in solving it. This way, they can replicate the solution in-house, while also leaving the door open to work with your consulting firm again in the future on another problem.

Photo courtesy of geralt

Why Use Market Research For A Consultancy Project?

If you haven’t yet, this would be the perfect opportunity to partner with a market research company. Your strategies and solutions are mostly born from your experience and expertise, but market research provides you with the data and insights to back up your advice. Sure, you can simply explain that your recommendations work because you’ve seen this happen before with the solutions you provided in the past and therefore it should work this time as well; market research achieves the same effect, except that it does the job with nuanced or layered explanations formed from case studies, working hypotheses, documented observations, referential works, and more.

In some cases where experience and expertise fall short, market research can serve as the foundation from which you develop your strategies and solutions by gaining a deeper understanding of not only the issue at hand but also other relevant factors such as the company, the competition, the customer base, trends, as well as the industry and the market itself, through quantitative and qualitative analysis. Market research goes beyond helping solve company problems; it can also help consulting firms guide their clients’ growth and business, increase brand awareness, and reach sales goals by resonating with their target audience through a data-driven and context-based approach.

Market research can also be key in helping you compete with or stand out from other firms. It can help determine key points in your competitors’ strategies to help differentiate your marketing approach or discover and tap into marketing space or niche audiences that they haven’t targeted. Sure, your competitors can utilize market research just as well, but if they’re only using it to support their existing business solutions and strategies while you leverage it to uncover new answers or innovate specific or contextual tactics for your clients, that can help get you a leg up over them.

Photo courtesy of geralt

How To Conduct Market Research for a Consulting Project

The process for conducting market research for a consulting project can be broken down into a few steps, starting with determining the focus of the research by defining the problem we want to solve or the goal we plan to achieve. In most cases, the focus may already be informed by the client and the project theme itself. From there we’ll shape the primary question we’re looking to answer, then form secondary and tertiary questions out of it, deriving the data types and sources we’re going to need along with the criteria and metrics from which we’ll measure the progress and success of our research.

Next, we’ll pick the research method we’ll be employing, which will be based on the type and sources of data we need and will use. Are you doing primary market research to gather firsthand data from your target audience or the market itself? Are you planning to complement your primary research findings with existing data from external sources through secondary market research?

Interviews, focus groups, and surveys are commonly used when gathering data directly ourselves, but if they fit our needs we can also utilize the top-down or bottom-up approaches. The former approach sees our research start with smaller elements to gain data for insights leading to a larger picture, while the latter has us researching first on a broader level with the resulting data used to learn specifics. We can also refer to previous but similar projects which can help save time and resources, but bear in mind that we might need data specific to the present context to arrive at the ideal solution for that project.

We’ll next proceed to data collection and analysis wherein we’ll observe and record the research process, taking note of any difficulties and divergences, while checking the quality and validity of our data through testing, cross-validation, and the like. We’ll be looking out for patterns, trends, correlations, and even differences, along with their implications and insights. We’ll also use statistical tests, confidence intervals, or error margins to evaluate the reliability and significance of our results.

When presenting our findings, it’s best to deliver what we discovered in a clear and concise yet engaging manner using language and visuals appropriate for our audience. For example, a somber, businesslike tone and straightforward visuals used when presenting to a room of executives and higher-ups might not work as well with a group of creatives. Perhaps communicating your findings in a story-like fashion to the latter might inspire their interest more and get your points across better by stirring their imagination. Visual tools can include reports, presentations, dashboards, or infographics, with highlights focusing not only on key takeaways and recommendations but also on any limitations we encountered or assumptions we made.

Photo courtesy of geralt

How To Find The Right Market Research Group For Your Consulting Firm

Not all market research companies are the same, of course. You’ll find large MR firms that employ different teams for every phase of your consulting project as well as smaller groups with one unit dedicated to overseeing the entire process from start to finish. You would want to go with a market research group that not only has some experience working with consulting firms but also does a regular volume of business with consultancies in the current day. Their experience would most likely translate to a higher understanding of the nature and challenges of your consultancy business in addition to adapting and aligning more easily with your goals and the way you do consulting work.

When interviewing market research teams you’re considering working with, you might want to ask them for any instance or past case history they can share wherein despite limited time, resources, and funds, they were still able to deliver outstanding insights and results. This will indicate how they perform under pressure as well as gauge their competitive drive.

But just because they rose above past difficulties and limitations doesn’t mean you’ll be short with them. On the contrary, you need to ensure your chosen market research team not only has the proper tools and resources but also enough time, room, and funding to help them perform their job well. Their success is, after all, your success. Allow them the freedom to use their discretion to take risks, experiment, or innovate, since the breakthroughs they find can make the difference in the quality and ingenuity of your business strategies compared to that of your competitors.

Let your consulting firm stand out from the rest of the competition with data-driven strategies and insights-based solutions for your clients that high-quality and high-level market research can achieve. Partner with Cascade Strategies and back up your consultancy with groundbreaking methodologies and over three decades of market research experience that other leading US and international companies have benefited from. Contact Cascade Strategies today and find out how we can help your consulting firm solve problems and achieve your goals.

Photo courtesy of 089photoshootings

Apr

Market research has proven itself to be an indispensable and critical tool in helping companies identify their audiences and achieve their marketing goals. As with any tech company, market research groups can come from small or large firms. You might be inclined to go with a larger market research firm because of the common adage “Bigger is better,” but you just might be surprised by what a smaller market research group can accomplish for you and your big tech company.

What makes smaller market research firms different from their larger counterparts? What are the advantages of working with a small market research group? Off the top of your head, you might think that cost-effectiveness is the main reason. But it goes well beyond that. Here are three good reasons why partnering with a small market research firm benefits your big tech company:

Copyright: geralt

One Team from Start to Finish

From the initial sales meeting to the project’s conclusion and implementation of recommendations, you’ll be interacting with the same team throughout. With a larger company, you might need to work with different teams for every phase of the project, and you might find yourself having to repeat yourself now and then, especially with the nuances of what you want or what the project needs. There’s also a risk that certain details and preferences might be overlooked or don’t get passed on as you switch from one team to another as you move through the phases.

Not only is there a seamless transition between stages of the projects with one team, but Cascade Strategies also employs veterans of the industry who bring to the table a potent combination of well-rounded skillsets and experience. Not only are they able to effectively understand your preferences and ideas no matter which phase of the project you’re in, but they also can oversee and recognize the effects of those concepts in the grand scheme of things or when they would come into play.

Copyright: ar130405

Better Communication and Responsiveness

With a smaller but experienced team, communication lines are much more open with members empowered to act or resolve issues when the opportunity arises. A project might encounter delays with a larger firm of multiple teams due to miscommunication (“I wasn’t informed”) or hindrances resulting from the division and distribution of roles and responsibilities (“Not my job”). Thus, a smaller team might also be more available and receptive when it comes to assisting a client whenever they raise a question or concern.

One team alone holding a meeting might slow down the overall progress of others working on the project, so just think of the impact if multiple groups need to take time off for discussions and calibrations. The time multiple teams take for meetings can be time used by a smaller team for revisiting ideas and scenarios until a “breakthrough” is achieved.

You might also find a smaller team is more invested in the project, hence the clearer communication and quicker responses. Multiple teams might be handicapped with multiple projects going on at the same time and the need to meet deadlines. A smaller team might handle more than one case study at once, but given that they’re overseeing the whole thing from start to finish, there exists a passion to get everything done right, and seeing the client and team’s visions come true no matter how big or small a project is.

Copyright: geralt

Culture

Speaking of passion, you might find a smaller market research firm having a more “can do” attitude and approach to your project. Not only that but at Cascade Strategies, we continually push the limits of what can be done and achieved with a project to reach that “breakthrough” that you might not have otherwise found had you gone with a different market research firm. A larger market research company on the other hand might be hustling to come up with conventional or simplistic ideas for you just to meet deadlines and deliverables.

Copyright: Kindel Media

Big Tech Company Case History

Take for example an academic software transformation project Cascade Strategies completed for a large global producer of industrial software. We conducted depth interviews with worldwide universities to develop a working hypothesis that would help formulate an implementation roadmap. We recruited academic decision-makers as respondents from a list provided by the project’s Software as a Service (SaaS) project director and supplemented by our panel. The interviews lasted roughly 45 minutes, with four in each of 16 countries for a total of 64 in-person depth interviews.

The study resulted in a working hypothesis with not one, not two, but three important premises, chief of which revealed that the respondents can be divided into the following two groups: the Elite and the Rank & File. The former are respondents from universities with a sophisticated preference towards the software provided to the students and typically have greater-than-average resources as well as uniform policies regarding software acquisition. The latter came from academic institutions demonstrating a pragmatic and single-task-focused approach to providing software to the students, and they often don’t have the full resources or uniform policies for software acquisition.

The second premise was that industry partnerships create pressure for constant advancement and higher sophistication of the software used for teaching, especially in the pursuit of true industrial replication. The third premise was that the pace of change is overwhelming for the Rank & File — too much for them to manage without guidance and assistance from the industry itself. Software makers who showed themselves willing to support academic institutions in this way we called “Industry Guides.”

Based on these three premises, our working hypothesis was that the software providers should clearly and publicly demonstrate equal concern for the Elite and the Rank & File when it comes to SaaS products and programs. This can be achieved with the re-introduction of product tiers, offering rudimentary beginner-level products such as simple tutorials and help functions as part of efforts to nurture at a basic level and push for industry partnerships, helping drive the Rank and File towards gradual sophistication in the software they use for teaching. Additional research into the needs and wants of the Rank & File could also lead to the creation of broad-based communications programs as well as specific single-university special programs aligned with these efforts.

This case history is one of many examples showing how our market research firm has consistently helped big tech companies for over three decades. From dramatically increased sales to award-winning marketing campaigns, we help big tech companies accomplish their goals and resonate with their target audiences with the valuable and actionable insights produced by the high-level and quality market research we provide. It’s not only our passion but also the high level of human intelligence and imagination we apply that adds a deeper value to the insights we derive for your project outcome.

If you would like your brand to break past ordinary bounds and achieve true excellence in its next campaign, contact Cascade Strategies today and find out how we can help you.

Mar

Can Psychographic Segmentation Help Financial Services Companies?

jerry9789 0 comments Brand Surveys and Testing, Burning Questions

Why Is Market Segmentation Effective?

By now you’ve most likely come across the idea that instead of using the “blanket” approach for marketing by using demographic or geographic data, you and your marketing goals can be better served by identifying your ideal customer and then focusing and tailoring your marketing campaign towards that consumer. This is achieved through a high-quality segmentation study and persona development, as was the case with the “Strivers” and “Empath” personas in our Banner Bank and Capital One case studies, respectively.

To sum it up, when we developed a brand model identifying “Strivers” as the primary segment Banner Bank should focus on, they were able to not only meet but also exceed all key Striver product targets system-wide after two years of implementing the program. Also, we recommended Capital One focus their brand campaign efforts for a personal investment mobile app on the pragmatic thinking type “Empath,” resulting in a highly successful new product introduction. You can learn more about these two case studies and how great research can help financial services companies here.

By recognizing your profit-optimal customer through market segmentation, a financial services company can effectively focus its marketing efforts and resources, optimizing or helping drive down costs, while at the same time engaging more efficiently with the consumer, enhancing satisfaction and loyalty.

But what if we tell you that you can also segment your financial services market so you target not one but different groups of customers?

Copyright geralt (Pixabay)

Single-segment Focus vs. Multi-segment Strategies

“Now hold on a minute,” you might say in your mind as you read that last line. “Didn’t you just say at the beginning of this that identifying your best customer is better than the ‘blanket’ approach?”

Yes, we did say that but no, this is no “blanket” approach. The main reason a financial services company wants to complete market segmentation research is so they can gain actionable insights into how to sell more of their products or services. With high-quality segmentation studies, breaking down your financial services market into different groups uncovers a variety of insights allowing you to craft and leverage different marketing strategies toward these segments. With this data-driven approach, customer segmentation helps financial services companies decide how to offer a customized journey to different kinds of consumers. It also provides the opportunity to tap into niche segments, which are usually smaller groups with considerable potential.

Think of it this way: instead of a blanket, what you have is a different set of marketing playbooks for your various customer segments. The blanket covers primarily the “who” of your market; each of your playbooks identifies not only “who” they are for but also deep dive into answering questions like “what” type of buyer behavior they have, “why” they behave this way, and “how” best to approach and engage them.

Copyright Gerd Altmann

Why Use Psychographic Segmentation?

Generally, four types of market segmentations can provide a financial services company with actionable segments: Geographic Segmentation, Demographic Segmentation, Behavioral Segmentation, and Attitudinal or Psychographic Segmentation. Out of these four, we’ll be focusing on Attitudinal or Psychographic Segmentation, as it is often considered the most useful way to segment an audience.

Attitudinal or Psychographic Segmentation separates customers by how they think and feel, their attitudes and values. Essentially, it aims to become a window into a buyer’s thought process. It is often considered the most useful segmentation approach because it provides the clearest actionable steps for a company to take as they try to target each segment.

Not only do you gain a deeper understanding of who your customer is, but your financial institution can map out the customer journey more effectively and efficiently with Psychographic Segmentation. It also allows the financial services company to recognize opportunities to offer different or new products/services in response to changes in consumer behavior. In addition to improved customer satisfaction and retention resulting from a client feeling valued, a financial institution that effectively engages with its consumers can also enjoy increased brand perception, helping with word-of-mouth and referrals as well as stand out from the competition.

Segmentation study data can come from several sources including survey data, observational data, public panel data, customer relationship management (CRM) databases, and even large-scale public databases such as Data Axle (previously InfoUSA), Experian, LiveRamp (previously Acxiom), and the like. It’s also possible to append demographic and behavioral data to your company’s house list. A financial services company is already sitting on a large pool of customer data; while it’s easy to go down the route of Geographic or Demographic Segmentation when analyzing all that information, converting those data into actionable insights with Psychographic Segmentation would lead to more personalized and meaningful buyer experiences.

Whether it’s for single or multiple segments, Psychographic Segmentation studies can tell you why a particular marketing or messaging approach to a particular segment is likely to be profitable. They can also tell you how to make adjustments toward more effective approaches when the standard approaches are not working. There are many financial services companies that tried demographic targeting and were disappointed with the results, then switched to psychographic targeting and found that their messaging strategies produced much higher rates of response and conversion.

Copyright Andrea Piacquadio

Cascade Strategies combines the most advanced AI and machine learning tools with market research expertise from over three decades of experience. Let us help your financial services firm convert your customer data into valuable, real, and actionable business insights. Don’t settle for a simple breakdown of your customer data; our experienced team strives for genuine breakthroughs by imaginatively interpreting all that complex quantitative segmentation data. We can also develop creative briefs that can be used for your advertising and website strategy based on the segments we discover, as well as tackle practical tasks, such as predicting the likely revenue to flow from campaigns directed toward specific consumer segments and measuring the actual monetary effectiveness of such campaigns. Contact Cascade Strategies today to see how our approach to segmentation studies can give you real business insights.

Nov

The Importance of Psychographic Segmentation in Brand Building

jerry9789 0 comments Brandview World, Burning Questions

What Is Psychographic Segmentation?

![]() So you’ve completed your research on the demographics of your online perfume store and you’ve seen that women in their twenties in Seattle were your top buyers. That’s great, you thought as your mind started to work on the outlines of your next campaign targeted towards these women. However, you discovered upon going through the data one more time that your perfumes are just as popular with forty-something-year-old women in Las Vegas. And when you went to double-check again you discovered another group of women around 25 years old being ardent supporters of your perfumes, but this time they’re from New York.

So you’ve completed your research on the demographics of your online perfume store and you’ve seen that women in their twenties in Seattle were your top buyers. That’s great, you thought as your mind started to work on the outlines of your next campaign targeted towards these women. However, you discovered upon going through the data one more time that your perfumes are just as popular with forty-something-year-old women in Las Vegas. And when you went to double-check again you discovered another group of women around 25 years old being ardent supporters of your perfumes, but this time they’re from New York.

Now how do you go about your marketing given that you would need to adjust it to target your top demographic? Sure, you’ve identified your best patrons as women between 20 and 50 years old but aside from the different locations, you’re not quite sure now what else sets them apart, which could poke holes in your messaging and cause it to fail to resonate with a number of them.

This exercise shows you the limitations of demographic-based marketing. Demographics answer the question “Who are your buyers?” but in order for your efforts to become more effective, you need to go deeper by answering “Why are they buying?” And this is where psychographic segmentation comes in.

Psychographic segmentation is the process of grouping consumers according to their motivations, goals, attitudes, opinions, beliefs and other psychological factors. It helps you better understand what drives purchase decisions. Not only does psychographic segmentation allow you diversify your marketing and reach out to different groups of consumers, it also allows you to create or customize products or services to cater to the varying needs of your buyers.

Copyright Elf-Moondance (Pixabay)

Why is Psychographic Segmentation Important in Brand Building?

Going back to the earlier scenario, you decided to reach out to your target demographic through an online survey, explaining it would help you understand them and serve their needs better. Based on the responses you received, you discovered that these women between 20 and 50 years old from different states appreciated the sweet-smelling but unique line of perfumes you’ve been selling at cost-effective pricing with efficient delivery times. Thus, the messaging of your next campaign highlighted the popularity of your sweet-scented perfumes, competitive pricing, and quick delivery. And the next time the opportunity presented itself, you even went as far as offering free delivery for a limited time.

Because you’ve used psychographic segmentation to break your market into different groups, you’ve also become aware of your other customer segments, which opened up marketing strategies you could leverage towards these subsets. Let’s say one of these groups was composed of regular clients who — although they didn’t buy as much as the earlier group we’ve discussed — you discovered frequently bought a certain perfume. Upon further research, surveys, and interviews of some of the members of this segment, you found that you’re the only online perfume shop that carried this fragrance. This then allowed you to branch out with new marketing which put a spotlight on the fact that this hard-to-find scent could only be bought at your online store, tapping into more potential customers falling under this segment. This also opened up more research on what fragrances your competitors didn’t offer but which your brand carried as well as the development of new unique perfumes that one wouldn’t find anywhere else online.

Psychographic segmentation not only gave you an understanding of the “why” behind purchases, it also granted you actionable insights on selling more of your products. With this data-driven approach, your brand is able to create different marketing playbooks for your various customer segments. The buyer’s journey would be different per customer, but in their minds there is only one brand that’s on top when it comes to a selection of unique scents at great prices and fast turnaround time for delivery.

Copyright Mohamed_hassan (Pixabay)

What Are Psychographic Segmentation Variables?

So how do you group your market according to your psychographic segmentation data? While there are several types of psychographic data on which you could base the customer segments you’ll be forming, indeed.com listed the following as the five main psychographic segmentation variables:

1. Personality – This variable refers to the beliefs, motivations, behaviors, and overall outlook of your target audience. You can group your customers based on personality traits like creativity, sociability, optimism, empathy, etc.

2. Lifestyle – This variable focuses on the daily habits and preferences of a customer, including how they spend their time and things they consider important.

3. Social class – This variable assumes preferences based on income level and spending power. It can also influence how a product is priced or whether it should be marketed as a luxury.

4. Attitudes – This variable considers the behavior of a customer based on their background and values. An example would be an animal lover who leans towards perfume brands that are known to be cruelty-free, meaning they don’t test their products on animals.

5. AIO (Activities, Interests and Opinions) – This variable groups consumers based on what they similarly enjoy or are passionate about. The second scenario earlier where you discovered the subset of regular customers purchasing the hard-to-find fragrance is an example of this variable.

Copyright geralt (Pixabay)

Personas vs. Psychographic Segmentation

While it might be easy to confuse psychographic segmentation with personas, these two concepts are subtly different. Psychographic segmentation groups your markets according to similar psychological traits and can therefore present a whole-market picture of consumers, spanning the range from those who passionately love your market offering to those who dislike it or resist it. This whole-market look also gives you the ability to attach real numbers to the data, enabling you to do things like demand forecasting, market sizing, receptivity studies based on counts of prospects, and the like.

Personas, on the other hand, are profiles — portraits of individual persons. They are more specific, detailed, and focused. Think of a police profile of a crime suspect (just the format of it, not the content.) A well-drawn persona presents a fictionalized representation of your ideal buyer, with information about key traits of that person. You might describe these traits by saying something like “likes to splurge on expensive vacations,” or “typically employed in middle-echelon white-collar jobs like administrative staff, etc.” The persona provides a vivid description of that individual, so you can better understand how to appeal to that kind of person with marketing campaigns and other forms of brand outreach. A good persona description humanizes the data and gives it a relatable face.

Please click here to find out more about segmentation studies, including some interesting case histories. Cascade Strategies has for over three decades been assisting top US and international companies with high quality market research and superior thinking in identifying and focusing on their most profit-optimal consumers. If you would like to find out more, or learn how Cascade Strategies can help provide brand development research for your specific marketing needs, feel free contact us here.

Sep

What It Means to Choose or Decide In The Age of AI

jerry9789 0 comments artificial intelligence, Burning Questions

Longstanding Concerns Over AI

From an open letter endorsed by tech leaders like Elon Musk and Steve Wozniak which proposed a six-month pause on AI development to Henry Kissinger co-writing a book on the pitfalls of unchecked, self-learning machines, it may come as no surprise that AI’s mainstream rise comes with its own share of caution and warnings. But these worries didn’t pop up with the sudden popularity of AI apps like ChatGPT; rather, concerns over AI’s influence have existed decades long before, expressed even by one of its early researchers, Joseph Weizenbaum.

ELIZA

In his book Computer Power and Human Reason: From Judgment to Calculation (1976), Weizenbaum recounted how he gradually transitioned from exalting the advancement of computer technology to a cautionary, philosophical outlook on machines imitating human behavior. As encapsulated in a 1996 review of his book by Amy Stout, Weizenbaum created a natural-language processing system he called ELIZA which is capable of conversing in a human-like fashion. When ELIZA began to be considered by psychiatrists for human therapy and his own secretary interacted with it too personally for Weizenbaum’s comfort, it led him to start pondering philosophically on what would be lost when aspects of humanity are compromised for production and efficiency.

Copyright chenspec (Pixabay)

The Importance of Human Intelligence

Weizenbaum posits that human intelligence can’t be simply measured nor can it be restricted by rationality. Human intelligence isn’t just scientific as it is also artistic and creative. He remarked with the following on what a monopoly of scientific approach would stand for, “We can count, but we are rapidly forgetting how to say what is worth counting and why.”

Weizenbaum’s ambivalence towards computer technology is further supported by the distinction he made between deciding and choosing; a computer can make decisions based on its calculation and programming but it can not ultimately choose since that requires judgment which is capable of factoring in emotions, values, and experience. Choice fundamentally is a human quality. Thus, we shouldn’t leave the most important decisions to be made for us by machines but rather, resolve matters from a perspective of choice and human understanding.

AI and Human Intelligence in Market Research

In the field of market research, AI is being utilized to analyze a multitude of data to produce accurate and actionable results or insights. One such example is deep learning models which, as Health IT Analytics explains, filter data through a cascade of multiple layers. Each successive layer improves its result by using or “learning” from the output of the previous one. This means the more data deep learning models process, the more accurate the results they provide thanks to the continuing refinement of their ability to correlate and connect information.

While you can depend on the accuracy of AI-generated results, Cascade Strategies takes it one step further by applying a high level of human thinking. This allows Cascade Strategies to interpret and unravel insights a machine would’ve otherwise missed because it can only decide, not choose.

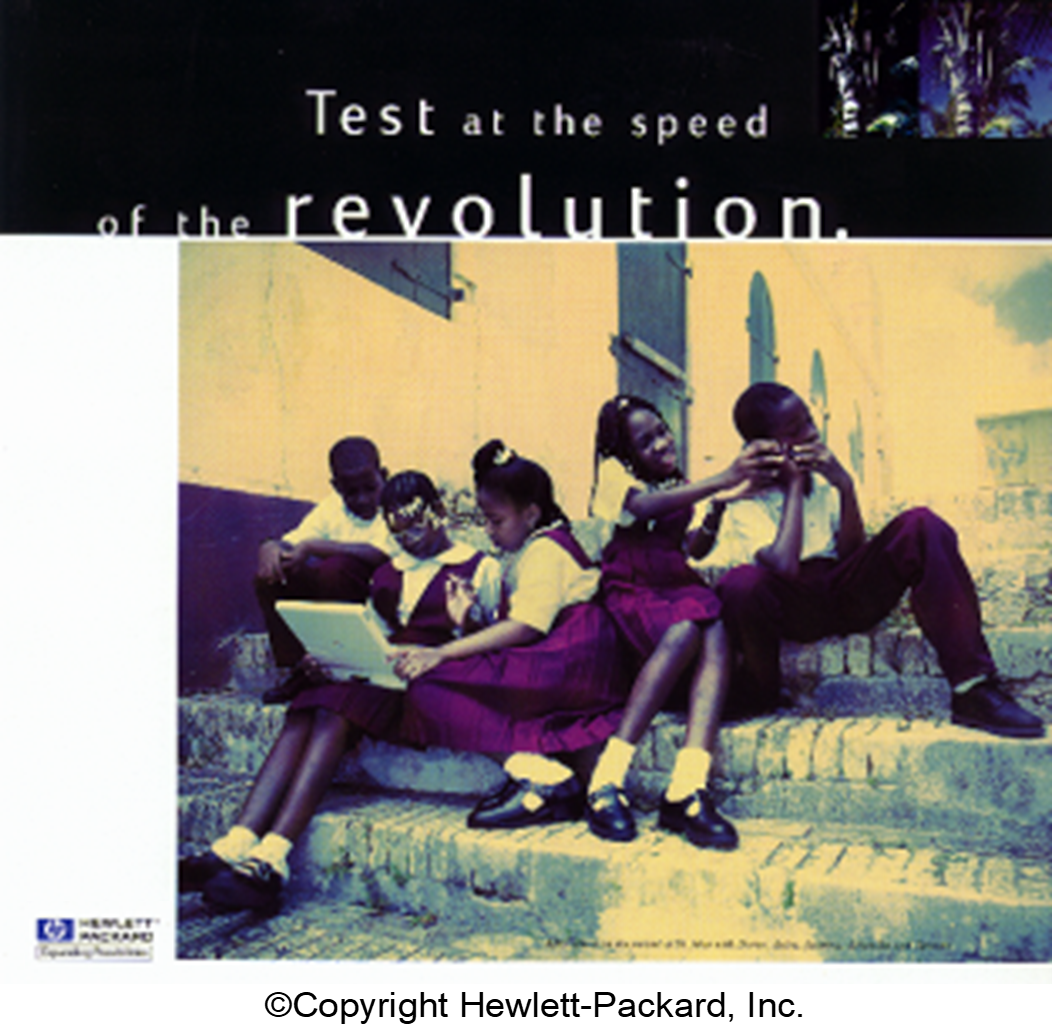

Take a look at the market research project we performed for HP to help create a new marketing campaign. As part of our efforts, we chose to employ very perceptive researchers to spend time with worldwide HP engineers as well as engineers from other companies.

This resulted in our researchers discovering that HP engineers showed greater qualities of “mentorship” than other engineers. Yes, conducting their own technical work was important but just as significant for them was the opportunity to impart to others, especially younger people, what they were doing and why what they were doing was important. This deeper level of understanding led the way for a different approach to expressing the meaning of the HP brand for people and ultimately resulted in the award-winning and profitable “Mentor” campaign.

If you’re tired of the hype about AI-generated market research results and would like more thoughtful and original solutions for your brand, choose the high level of intuitive, interpretive, and synthesis-building thinking Cascade Strategies brings to the table. Please visit https://cascadestrategies.com/ to learn more about Cascade Strategies and more examples of our better thinking for clients.

Aug

How Can Healthcare Companies Identify Who Needs Remediation Programs?

jerry9789 0 comments artificial intelligence, Burning Questions

What Is Remediation?

The Cambridge Dictionary defines remediation as “the process of improving or correcting a situation.” Remediation programs are commonly employed in teaching and education wherein they address learning gaps by reteaching basic skills with a focus on core areas like reading and math. And as pointed out in an understood.org article, remedial programs are expanding in many places in our post-COVID 19 world.

In healthcare, there’s a wide range of remediation programs, or “remedial care,” diversified based on their end goal which may include smoking cessation, anti-obesity, weight reduction, diet improvement, exercise, heart-healthy living, alcoholism treatment, drug treatment, and more. But how do you identify the people who need remedial care the most?

Who Needs Remediation?

You might say you can tell who needs remedial care by just looking at the physical aspect of the prospective patient, but this is a shortsighted answer to the question. And what about those who need remedial care for a heart-healthy lifestyle? Surely you can’t tell a likely candidate for this remediation program with just one look alone.

It goes deeper than that. What if you, a healthcare representative, could only devote remedial care to a select few individuals given limited resources and time but you want to make sure that the whole remediation program is successful by achieving its intended goals? Just imagine all that time, effort and resources spent only for the patient to relapse back into their old ways not too long after program completion- or even in the middle of the remediation process itself.

Deep Learning and Remediation

This is where deep learning comes in. Also known as hierarchical learning or deep structured learning, Health IT Analytics defines deep learning as a type of machine learning that uses a layered algorithmic architecture to analyze data. In deep learning models, data is filtered through a cascade of multiple layers, with each successive layer using the output from the previous one to inform its results. Deep learning models can become more and more accurate as they process more data, essentially learning from previous results to refine their ability to make correlations and connections.

Deep learning models handle and process huge volumes of complex data through multi-layered analytics to provide fast, accurate, and actionable results or insights. When applied to the scenario we mentioned beforehand, deep learning filters through that multitude of patient data and prioritizes those who need remedial care the most.

You can also align its findings to effectively identify individuals who will not only return monetary value to your healthcare brand, but at the same time are most likely to “engage” or participate in programs offered by your company, such as wellness, diet, fitness or exercise. They can also be the best people to commit to avoiding poor lifestyle choices, such as overeating, smoking, and alcohol, helping guarantee the success of the remediation program.

With a combination of three decades of market research experience and conscientious use of AI, Cascade Strategies has been helping healthcare organizations develop advanced models to handle, filter and identify the likeliest of candidates for their program purposes. Cascade Strategies helps industry professionals not only recognize their ideal customers but also reach out to them with some of the most effective and award-winning marketing campaigns, thanks to our array of services such as Brand Development Research and Segmentation Studies. To see more examples of how we help leading worldwide companies achieve their goals, please visit our website.

Here are some of our suggestions for further reading on deep learning and healthcare:

https://builtin.com/artificial-intelligence/machine-learning-healthcare

https://research.aimultiple.com/deep-learning-in-healthcare/

https://healthitanalytics.com/features/types-of-deep-learning-their-uses-in-healthcare

Jun

Kyle Byers of Exploding Topics has written recently about nine key trends in the CPG industry. We’d like to focus on those nine trends below, add one of our own, and talk about how market research has responded to these trends.

From food and drinks to apparel and cosmetics, consumer packaged goods (CPG) are a vital part of everyday life for most consumers and households. Since these products are mostly disposable, there is a regular need and consistent demand for replenishment or replacement, forming the basis for a competitive environment for all brands.

The CPG market has significantly and steadily grown despite the competition and even more so with the COVID-19 pandemic. It was valued at $2.06 trillion in 2021 and with a compound annual growth rate (CAGR) of 3.5%, it is estimated to reach $2.8 trillion by 2030.

In addition to the pandemic, new technologies and consumption habits have contributed to the rapidly changing face of the CPG industry. From direct to consumer (DTC) to sustainability to product personalization, we’ll take a closer look at 10 of the most important trends impacting the CPG industry right now.

1. Legacy CPG Companies Join DTC

DTC online sales growth in 2022 is estimated at $138.03 billion, so you can understand why CPG industry stalwarts couldn’t ignore the DTC wave any longer, joining the trend three ways. First by acquiring competitors, like Unilever who counts Dollar Shave Club, Schmidt’s Naturals and UK-based Graze among its many DTC acquisitions since 2015. Second, they are launching entirely new brands, like Procter & Gamble’s EC30 which is an eco-oriented brand of dissolvable, solid-form soaps and cleaning products. And thirdly, by launching DTC sites like PepsiCo’s PantryShop.com and Snacks.com. These sites went up during the Coronavirus pandemic and PepsiCo nearly doubled their DTC sales in Q3 2020.

2. CPG Startups Emerge to Make Their Mark

Without a middleman and the need for retail shelf space, the DTC business model fosters competition. Many DTC startups use a subscription model to generate steady and recurring revenue, allowing them to take a bite out of the market at the expense of traditional CPG brands. For example, Gillette saw its 70% share of the US razor market go down under 50% within a decade due to competition from Dollar Shave Club and Harrys.

3. More Retailers Launch Private Label Brands

Availability issues during the pandemic have partly contributed to the popularity of private-label products. With 65% of shoppers saying they’ll switch brands if prices are too high, being an affordable alternative also helps private-label brands gain ground in the market. Think Amazon’s private-label clothing brand Goodthreads, which is competing against big brands H&M, Levi’s, and Uniqlo. Better margins and direct control over product development have also convinced retailers like Walmart and Kroger to launch their own consumer brands.

4. Faster and Easier Delivery Than Ever Before

With the pandemic pushing e-commerce into overdrive, access to faster and easier delivery options is becoming a key point in purchasing decisions, according to 68% of shoppers in a recent survey. 85% of online shoppers say they will search for someplace else if the delivery time is too long, while 30% of consumers expect same-day delivery. This need for speed has given rise to dedicated fast-delivery CPG retailers like GoPuff who are offering to deliver not in days or even hours but in minutes.

Copyright Pixabay (Pexels)

5. Focus on The Omni-Channel CPG Shopping Experience

More and more CPG brands and retailers are pushing for omni-channel shopping, allowing a smooth and seamless purchasing experience across different devices, or even between in-store and online. To illustrate: Sephora enhanced in-store experience by letting customers access their online shopping lists called “Loves” on large screens inside stores with the help of in-store tablets. Compared to single-channel brands, CPG companies that utilize at least three retail channels have shown a 287% higher purchase rate.

6. Expanded Omni-Channel CPG Marketing

CPG companies are also leveling up their marketing with a more omni-channel approach. TV ads, product placements, PR, and digital marketing methods like PPC ads, which have proven their effectiveness time and time again, are now joined by the new kid on the block: influencer marketing. Even with as few as 1,000 social media followers, “micro” and “nano” influencers are able to deliver results for CPG brands tapping into these smaller, more focused niche experts.

7. Sustainability and Clear Brand Values Are More Important Than Ever

Another thing that the pandemic accelerated is the rise of green consumerism. Many consumers, mainly Gen Z, now avoid brands that don’t align with their stance on the environment and other sustainability issues. 53% of Internet users have expressed intentions to switch products or services if a company violates their personal values or they weren’t sustainability-focused.

8. Self-Care Product Demand Is Rising

The pandemic also brought to the fore holistic self-care, where consumers use multiple products to optimize their health and wellness. Skincare products are now outselling makeup, thanks to millennials who spend more on self-care than any previous generation, and CPG brands like CeraVe and DRMTLGY who have jumped at this opportunity.

Products containing cannabidiol, also known as CBD, were not legal nationwide in the US until 2018. Now, CBD products are a rapidly growing part of the self-care category, with sales at $4.6 billion in 2020 and expected growth of over $16 billion in 2026.

9. Growing Popularity of Product Personalization

Offering a personalized experience through product quizzes can boost e-commerce conversion rates while building direct, one-to-one relationships with customers. This was the goal behind beauty brand Tatcha offering personalization via its Ritual Finder tool.

In fact, 71% of consumers expect personalized interactions according to McKinsey. Conversely, 76% get frustrated when they don’t get them. 60% of consumers say they’ll become repeat customers after a personalized shopping experience.

Copyright Polina Tankilevitch

10. Gen Z Is Becoming a Major Part Of The Consumer Market

We’ve hinted this earlier, but this trend is just as impactful as the others, especially with the $143 billion of spending power that allows Gen Z to make up 40% of the entire global consumer market. With the shift to digital commerce, companies need to find creative and effective ways to tap into this massive demographic group and understand their buying patterns, especially with regard to social media. Did you know that 97% of Gen Z purchasing decisions are heavily influenced by social media, with 48% of consumers now likely to purchase directly from TikTok?

How Market Research Has Responded to These Trends

Based on these trends, we can assume the CPG market is moving into a personalized and multi-channel direction where leading brands are recognized not only for their competitive price points but also for their value propositions. There are four key ways in which the Market Research industry has responded to these trends and provided newer and more incisive tools for understanding consumer behavior.

1. The Shift from Perceptual Research to Transactional Research

Pandemic restrictions have long been lifted and brick-and-mortar locations have reopened, but there’s no denying that consumers have embraced e-commerce and the convenience it offers. Consumers will still appreciate the opportunity to test products in person with in-store shopping, but when there isn’t such a necessity, e-commerce becomes the go-to sales channel. This is especially true for those who have already established loyalty to a particular brand. Following this trend, there’s been a seismic shift away from perceptual research dealing with the in-store experience to customer research dealing mainly with degree of satisfaction at certain touchpoints in the e-commerce funnel.

Brand and Insights Managers increasingly seek hard metrics to support specific e-commerce initiatives, including product depictions on small and large screens, comparative text descriptions, active displays involving motion, sound, and animation, features such as reviews, promotion codes, side-by-side comparisons, visual try-it-on-yourself options, and options for shipping, group discounts, buy-now-pay-later offers, and repeat-purchase and subscription-purchase offers. While perceptual research can guide them in a general way, the degree-of-satisfaction metrics at these touchpoints in the shopping experience deliver more hard value to the decision maker who is tasked with determining the effectiveness of e-commerce marketing methods.

2. From Qualitative to Quantitative Methodologies

Another development is the shift away from common qualitative methodologies to quantitative methodologies. For example, years ago there was much more exploration of the spatial shopping experience via in-person focus groups, shop-alongs, visual diaries, ethnographies, and the like. A good deal of that has transitioned to quantitative research using direct metrics such as scalar degree-of-satisfaction measures delivered via web and text.

Fundamentally, the need-to-know among contemporary Brand Managers and Insights Managers is not so much “how does my brand’s expression attract consumers?” as it is “how satisfied are consumers with their experiences with my brand?” The first concern was well served by a variety of qualitative methodologies. While it’s still an active concern, it has declined somewhat, while the second concern has become white-hot. Quantitative methodologies on the whole do a better job of serving this second concern than qualitative methodologies do, especially given that brand “experiences” in the current day are less spatial and more virtual. This makes it easier to ask a consumer a transactional question such as “how did it go for you?” while the consumer’s mind is still fresh on the subject.

3. Less Packaging Research

There was a 30-year fascination – even obsession in some cases – with intriguing methodologies in packaging research, pioneered by big packaged goods companies like P&G, PepsiCo, Unilever, etc. These included eye tracking, neurometrics, GSR measurement, EKG measurement, facial coding, Virtual Reality and Augmented Reality simulations, million-dollar “cave” immersive environments, and more. These methodologies are still very much alive, but their application is different. At one time they were widely applied to virtually any inquiry associated with packaging or any stage in the PLM journey: product ideation, prototyping, functional testing, price/value research, comparative attribute research, virtual or physical shelf testing, test marketing, advertising, and even compliance. Now the applications are more narrowly focused on specific research outcomes, and maybe that’s a good thing.

For example, the fragrance people still love biometric methods, and the website testing people still love eye tracking. The people doing that research have specific research outcomes in mind, and these outcomes are often metric rather than perceptual. Are psychic arousals produced by certain aromas? Where do the eyes go when looking at a web page? These questions can be answered metrically via the biometric data. And these are experimental venues where the brain-body response can legitimately be expected to be driven by environmental stimuli – at least enough to be measured by instruments.

As a result, there’s less packaging research in the packaged goods business. The truth is that there’s less keen interest among Brand and Insights Managers in whether the packaging is compelling in a spatial retail environment. There’s more interest in the transaction itself. Brand and Insights Managers want to learn less about the motivations and behaviors involved in wanting the product and more about the motivations and behaviors involved in buying the product.

4. Systems as a Source of Insight

There is also now a greater focus on systems as a source of insight. For years, market research was the primary source of brand insight, so humans were involved by definition. Now the dominant sentiment is that insights come from machines, and humans tend the machines.

Marketing decision-makers are often heavily engaged in the determination of which analytics platform(s) will be implemented at their company, installing the platform and training users, maintaining the security of that platform, licensing issues, system upgrades, patches, maintenance advisories, hardware issues, and more. None of this has anything to do with deriving insights for the brand.

Copyright PhotoMIX-Company

The thought pattern here is that this time is well spent because insights arise from machines, not human effort. A human-focused effort to produce brand insights is still occasionally used, but it’s sort of like a landline phone: interesting but not contemporary.

Brand and Insights Managers in the current day have a passing interest in human-focused market research when the machines cannot produce the insight or do a poor job of it. An example would be the development of a vibrant persona for the brand, or a comprehensive market segmentation scheme involving all competitive brands. Systems and platforms can actually do this (including AI-assisted systems and platforms), but their outcomes are invariably suboptimal. The systems are recursive, and they therefore regurgitate the best-available summarizations of the data inputs they receive. Since they don’t have the intuitive, interpretive, and synthesis-building power of the human brain (especially the right brain), they cannot extrapolate to the level of excellence in their outcomes. In other words, they render mediocrity permanent.

It takes a brain strain – a smart person or two striving with higher intuitive/interpretive layers of thinking and understanding to discover solutions that cannot be reached by simply summarizing human experience on a topic – to produce excellence in these outcomes. The greater unanswered question is whether Brand and Insight Managers want excellence. These managers may be a little more system- and process-driven in their thinking, and they therefore may prefer a large volume of mediocre solutions rather than a single solution at the level of excellence.

How We Approach These Issues at Cascade Strategies

There’s currently a raging debate about the appropriateness and utility of applying AI instruments, especially ChatGPT, to marketing questions typically answered by market research and discussed in this article. Our point of view on this topic can be summarized by the term “Appropriate Use.”

Clearly, there’s big first-party data involved with these CPG trends, especially with DTC. While AI-powered analysis and interpretation of this big data can efficiently and quickly produce objective and accurate results, there is a space that AI is unable to touch and thus falls short of effectively leveraging data to make informed decisions. This area is where the intuitive, interpretive, and synthesis-building capacities of the right brain excel. Here data-driven decision-making could potentially access a different yet extraordinary set of insights, themes and recommendations anchored by human values and experience.

But sophisticated solutions at this level – the level of excellence – might remain undiscovered since machines don’t have the ability to relate to the data on an intuitive and interpretive level. A more enlightened “Appropriate Use” concept, which elevates the role of human inspiration and agency, could lead to more innovative and creative ideas about how CPG companies can optimize operations, forecast sales, develop products, enhance marketing strategies, focus on the most profit-optimal consumers, and develop the most compelling messages for those consumers.

For 33 years Cascade Strategies has demonstrated the capacity to maintain this kind of machine-versus-man balance for leading worldwide companies and thus produce excellence in thinking and outcomes. Please see examples of our higher thinking for clients at https://cascadestrategies.com.

Jun

How Great Research Produces Great Campaigns

jerry9789 0 comments artificial intelligence, Brand Surveys and Testing, Brandview World, Burning Questions

Can AI Produce Your Marketing Campaign?

If you were given the task of developing a global communications campaign for a technical products company, would you let ChatGPT do it?

You might, especially if you noted that ChatGPT could churn out dozens of ads like the one above without paying art directors, copywriters, media professionals, or users of a Demand Side Platform.

You might, especially if you noted that ChatGPT could churn out dozens of ads like the one above without paying art directors, copywriters, media professionals, or users of a Demand Side Platform.

But we wouldn’t. This is because it’s hard for AI to produce at the level of excellence, and excellence is what should be sought.

Seeking Excellence in Marketing Campaigns

The ad below is part of an award-winning and profitable “Mentor” campaign for HP. To arrive at this level, HP had to commission very perceptive researchers to spend time with worldwide HP engineers as well as engineers from other companies.

The researchers stretched the intuitive, interpretive, and synthesis-building capacities of their right brains to arrive at a subtle insight that AI would have great difficulty seeing: that HP engineers showed greater qualities of “mentorship” than other engineers. They thought it was important not only to conduct their own technical work, but to impart to others (typically younger people) what they were doing and why what they were doing was important.

It would be very hard indeed to stretch an AI chatbot (or other AI engine) to that deeper level of understanding about what a truly extraordinary ad should do to express the true meaning of a brand to people.

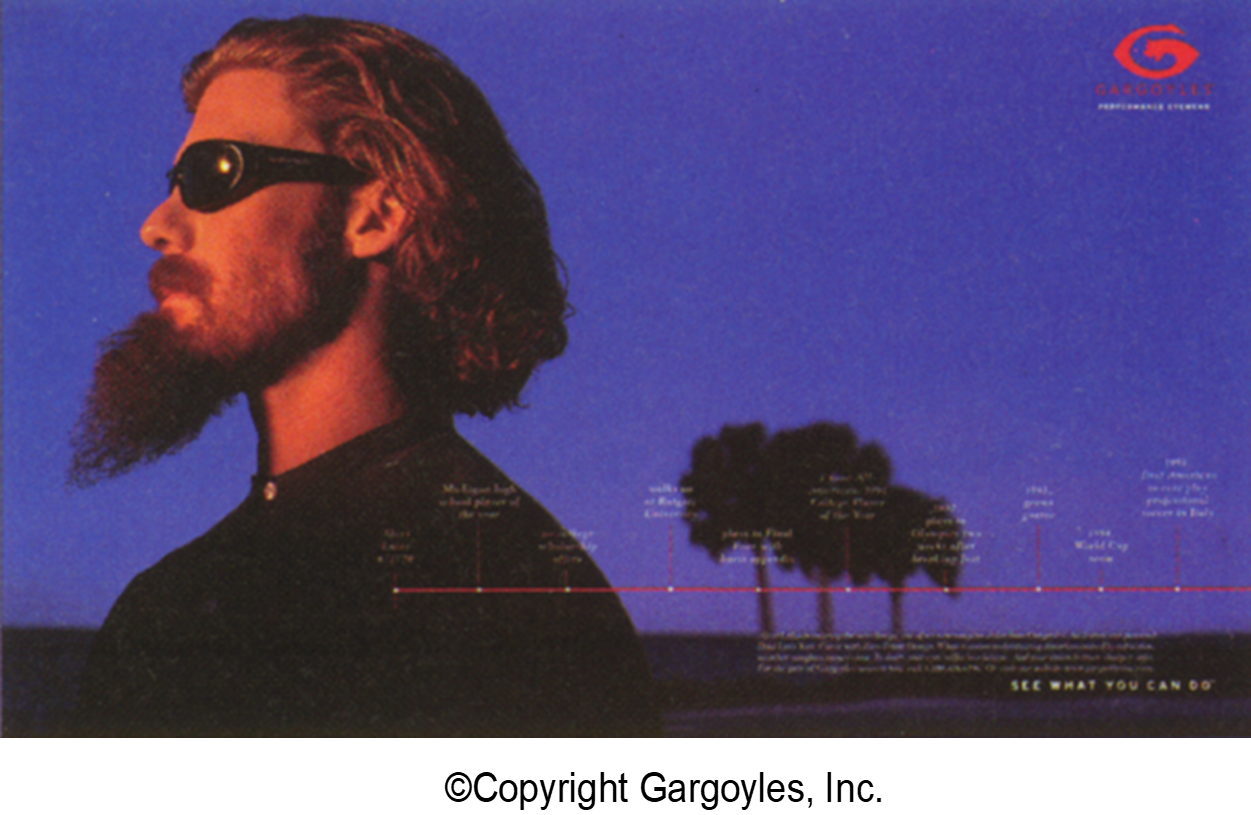

An example from the world of sunglasses

If you were given the job of developing a campaign for a line of sunglasses, you could probably get ChatGPT to produce a large number of ads like the following at little or no cost (with the exception of the cost of the talent).

But AI-produced ads fall short of excellence. AI simply cannot do the incisive interpretive work that humans can do to produce something better.

But AI-produced ads fall short of excellence. AI simply cannot do the incisive interpretive work that humans can do to produce something better.

Researchers working for the Gargoyles brand of sunglasses spent time with those who preferred this brand and made a discovery about them that AI engines would have great difficulty seeing: that many Gargoyles wearers were upward strivers who were at first destined to fail, then turned things around with drive, verve, and strenuous effort.

They had a “storyline of life” worth admiring. To gain this insight, the researchers had to stretch the intuitive and interpretive powers of their brains. They could not simply rely on a summarization of prior human experience in producing ads about sunglasses.

They had a “storyline of life” worth admiring. To gain this insight, the researchers had to stretch the intuitive and interpretive powers of their brains. They could not simply rely on a summarization of prior human experience in producing ads about sunglasses.

Higher powers AI cannot reach

AI cannot stretch to this level of excellence. It cannot see broader levels of human experience that may be required to produce excellence, such as “how could sunglasses have anything to do with striving?” or “how could a life story of struggling ever be associated with sunglasses?” Hell, generative AI wouldn’t even think to inquire about a storyline of life. But humans can do that when their right brains are performing at a very high level.

The researchers in this case had to sweat the details a little more, spend quality time pondering the higher thematic levels, and drive their brains well beyond summarization to a more sublime expression of the true meaning of a brand to people.

This is the kind of work Cascade Strategies does on a daily basis. Please have a look at some other examples of higher thinking for clients at https://cascadestrategies.com.

People are catching on and speaking out

More people are seeing the chasm between the summarization of human experience that AI can provide and the excellence provided by the greater intuitive powers of the human brain, and they are speaking out about it. One example is Po-Shen Loh, a charismatic math coach who directly confronts AI, challenging his students to attack complex math problems at higher levels of understanding and interpretation than AI could ever provide.

But there are even more people who are discovering this excellence gap, and their voices will grow stronger.